California pickup truck owners face important decisions about vehicle registration. The state requires different classifications for trucks based on their intended use. Understanding these differences can save money and prevent legal issues. Tradeizze provides valuable insights for truck buyers navigating these complex regulations.

The Golden State has specific rules governing truck classifications. These regulations affect registration fees, insurance requirements, and driving restrictions. Additionally, the classification impacts tax implications and operational permissions throughout California.

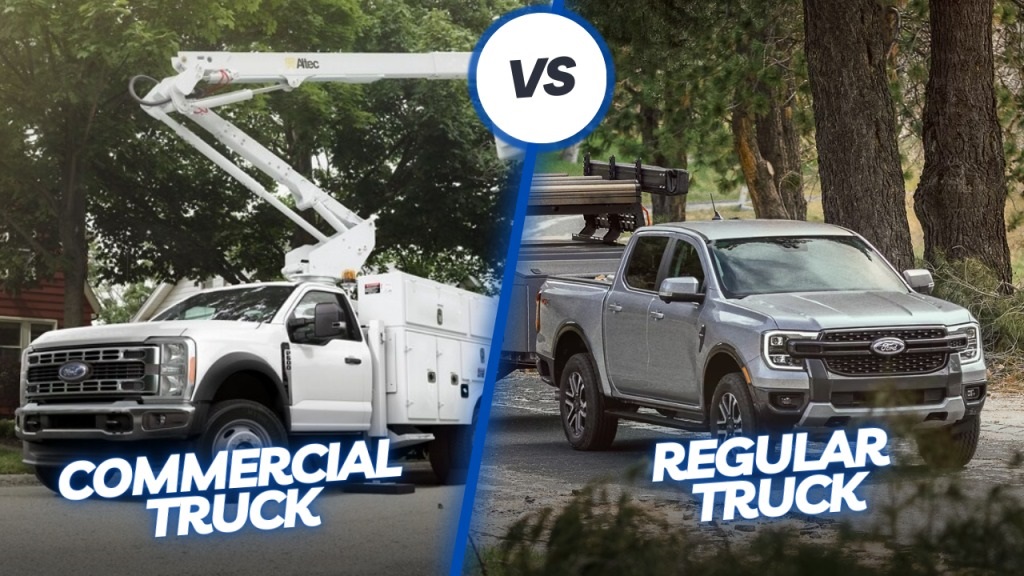

When considering a commercial vs private use pickup truck in California, owners must evaluate their primary vehicle purpose. This decision influences various aspects of truck ownership. However, many buyers remain unaware of these critical distinctions.

Understanding Private Use Pickup Trucks

Private use pickup trucks serve personal transportation needs. These vehicles transport family members, recreational equipment, and personal belongings. Therefore, they fall under standard passenger vehicle regulations in California.

Private registration typically costs less than commercial alternatives. The Department of Motor Vehicles treats these trucks similarly to regular cars. However, certain weight restrictions may still apply depending on the vehicle specifications.

Insurance for private pickup trucks follows standard auto insurance guidelines. Coverage options include liability, comprehensive, and collision protection. Additionally, personal use vehicles enjoy more flexible driving privileges throughout the state.

Commercial Pickup Truck Classifications

Commercial pickup trucks serve business purposes primarily. These vehicles transport goods, equipment, or materials for profit-generating activities. Therefore, California requires specific commercial registration and compliance measures.

Commercial registration involves higher fees and additional paperwork. The state monitors these vehicles more closely than private alternatives. However, commercial registration provides certain business tax advantages and operational permissions.

Commercial truck insurance requirements differ significantly from private coverage. These policies must include higher liability limits and specialized protection. Additionally, some commercial vehicles require specific endorsements or additional coverage types.

Registration Requirements and Processes

California’s DMV maintains strict registration procedures for both classifications. Private registration requires standard documentation including title, insurance proof, and identification. The process typically completes within a single visit to DMV offices.

Commercial registration demands additional documentation and verification. Business owners must provide company information, tax identification numbers, and operational details. Therefore, the commercial registration process often takes longer and requires more preparation.

Both registration types require annual renewals with updated documentation. However, commercial renewals may involve additional inspections or compliance checks. The state also maintains different renewal schedules for various commercial vehicle categories.

Financial Implications and Costs

Registration fees vary significantly between private and commercial classifications. Private pickup trucks typically pay standard passenger vehicle rates. These fees depend on vehicle value, weight, and model year.

Commercial registration costs more due to additional state requirements. These vehicles pay higher base fees plus various commercial-specific charges. However, business owners may deduct these expenses as operational costs.

Insurance premiums also differ substantially between classifications. Commercial coverage costs more due to increased liability exposure and business use risks. Therefore, owners should carefully consider their actual vehicle usage patterns before choosing registration types.

Legal Restrictions and Permissions

Private pickup trucks face fewer operational restrictions throughout California. These vehicles can access most public roads without special permits. However, certain weight limits and towing restrictions may still apply.

Commercial pickup trucks must comply with additional regulations and restrictions. Some areas limit commercial vehicle access during specific hours. Additionally, these trucks may require special permits for certain cargo types or weight categories.

Parking regulations also differ between classifications. Many residential areas restrict commercial vehicle parking overnight. Therefore, business owners must consider storage options when choosing commercial registration.

Weight and Size Considerations

California uses gross vehicle weight rating to determine classification requirements. Trucks exceeding certain weight thresholds automatically require commercial registration regardless of intended use. This rule affects larger pickup trucks and heavy-duty models.

Private use vehicles typically fall below commercial weight thresholds. Most standard pickup trucks qualify for private registration when used personally. However, modifications or accessories may push vehicles into commercial categories.

Commercial weight classifications involve multiple tiers with different requirements. Heavier trucks face additional regulations, permits, and operational restrictions. Therefore, buyers should understand weight implications before purchasing larger vehicles.

Tax Benefits and Implications

Commercial pickup truck registration provides various tax advantages for business owners. These benefits include depreciation deductions, operational expense deductions, and potential tax credits. However, proper documentation and legitimate business use are essential requirements.

Private pickup trucks offer limited tax benefits compared to commercial alternatives. Personal vehicle expenses typically cannot be deducted unless used for specific business purposes. Therefore, business owners should carefully evaluate their tax situations.

The IRS requires clear distinction between personal and business vehicle use. Mixed-use vehicles must maintain detailed logs documenting business versus personal miles. Additionally, improper classification can result in tax penalties and complications.

Making the Right Choice for Your Needs

Choosing between commercial and private registration requires honest evaluation of vehicle use patterns. Owners should consider primary purposes, frequency of business use, and long-term operational plans. This analysis helps determine the most appropriate and cost-effective classification.

Business owners using trucks primarily for work should strongly consider commercial registration. The additional costs often balance against tax benefits and operational permissions. However, occasional business use may not justify commercial classification expenses.

Personal truck owners should generally choose private registration unless business use exceeds personal use. The lower costs and fewer restrictions make private classification attractive for most individual owners. Therefore, careful consideration prevents unnecessary expenses and complications.

Read More Also: AI-driven Personalized Skincare Devices

Conclusion

Understanding the differences between commercial and private pickup truck registration in California helps owners make informed decisions. Commercial registration costs more but provides tax benefits and business operational permissions. Private registration offers lower costs and fewer restrictions for personal use vehicles.

The choice depends on primary vehicle use, business needs, and financial considerations. Proper classification ensures compliance with California regulations while optimizing costs and benefits. Therefore, truck owners should carefully evaluate their specific situations before selecting registration types.

Both classifications serve important purposes within California’s transportation system. Making the right choice protects owners from legal issues while maximizing operational efficiency and financial benefits.

Read More Also: How to Roller Skate Backwards for Beginners

Frequently Asked Questions

-

Can I change my pickup truck registration from private to commercial in California?

Yes, you can change your registration type through the California DMV. However, you’ll need to provide additional documentation for commercial registration and pay any applicable fee differences. The change typically requires a new registration application and proof of business use.

-

What happens if I use a privately registered pickup truck for business purposes?

Using a privately registered truck for significant business purposes may violate California regulations. The state may require commercial registration if business use becomes primary. Additionally, insurance coverage might not apply to business-related incidents with private registration.

-

Do electric pickup trucks follow the same commercial vs private registration rules?

Yes, electric pickup trucks must follow the same registration classification rules as traditional gas trucks. The power source doesn’t affect registration requirements. However, electric commercial vehicles may qualify for additional tax incentives and benefits.

-

How does pickup truck weight affect registration classification in California?

California uses gross vehicle weight rating to determine mandatory commercial registration. Trucks exceeding 10,000 pounds GVWR typically require commercial registration regardless of use. Lighter trucks can choose based on their primary purpose and usage patterns.

-

What documentation do I need for commercial pickup truck registration in California?

Commercial registration requires business license, tax identification number, insurance proof, vehicle title, and registration application. Some businesses may need additional permits or certifications depending on their industry and intended vehicle use.

Leave a Reply